In spite of soaring bankruptcies, the power to avoid them is readily available

“Bankruptcy filings spiked this year, and most small businesses aren’t doing well.” Sue Canyon points to a grim reality but insists, “It doesn’t have to be this way.”

Canyon’s experience, as revealed in this interview, demonstrates that she knows what she’s talking about. Early in her career, she apprenticed under a business mastermind at a Fortune 500 company. Using what she learned from her mentor, Canyon spent the next 30 years refining and honing her business-turnaround system while working with hundreds of businesses, their owners and employees.

“I’m astounded at the misconceptions and myths that I encounter on a daily basis,” Canyon says, “but before we get into that, I want to talk about these bankruptcy statistics. A 68-percent increase in business bankruptcies is sobering, and the data shows that 2023 is shaping up to be the biggest year for Chapter 11 filings in over a decade.”

But the reality is even worse than the data indicate, Canyon says. “For starters, the government changed the way they count bankruptcies, leaving hundreds of thousands of sole proprietorships out of the calculation, not to mention failed businesses whose owners managed to avoid bankruptcy.”

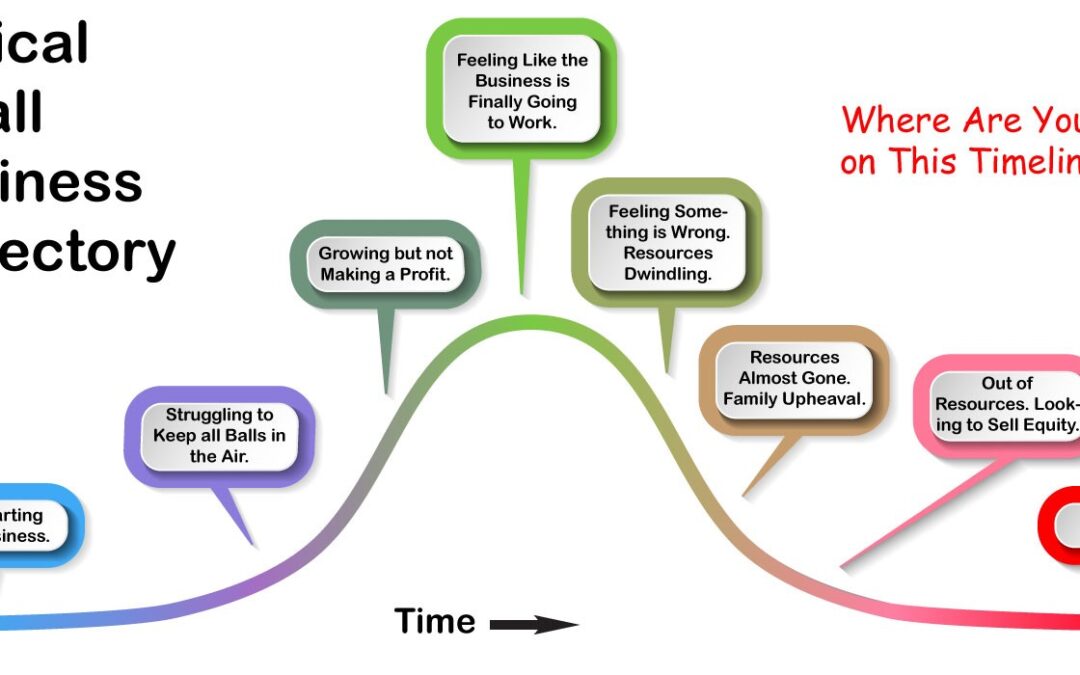

Small business owners face daunting challenges: flawed business practices, heavy debt and a lack of mentors. This combination can lead to what Canyon refers to as the “Walking Dead,” another category of failed businesses that aren’t accounted for in the statistics.

“These zombie businesses are failing on their feet,” Canyon says. “The owners of these businesses keep putting all their investment monies into their companies — retirement funds, second mortgages, college savings — and running up their credit card balances. With inflation and rising interest rates, it’s no wonder we’re seeing a wave of small business bankruptcies.”

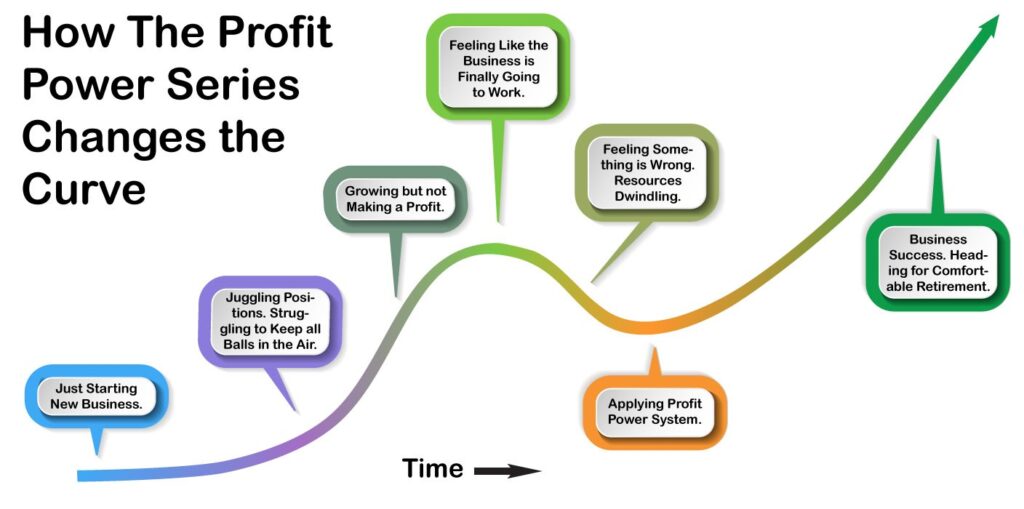

Canyon developed the Profit Power Series to offer training and tools that avoid bankruptcy and teach business owners a proven system to achieve a healthy business. “The Profit Power Series shows business owners how to implement a complete business system,” Canyon says. “Each chapter reveals essential elements of a healthy business and provides clear instructions on how to integrate them into any business.”

Each chapter builds on previous chapters, and Canyon says this incremental approach ensures that any business owner can “not only save a struggling business, but also turn that business into a fine-tuned machine.”

Here are a few examples of what entrepreneurs can expect from the Profit Power Series:

- Essential tools for cost reduction.

- More efficient and productive operations.

- Tactics for hiring and keeping good employees.

- Planning strategies that get businesses on track and keep them on track.

- How to read financials to predict the future.

- Effective operations management.

- The proper way to determine costs and ensure adequate margins.

- Effective methods for handling growth.

- Continuous quality improvement.

Canyon insists it’s not rocket science, “but it is science, the well-established science of business. Once the Profit Power system is put in place, the business will run smoothly with less effort, employees will be more involved and supportive, and the owner will have more free time to enjoy the benefits of business ownership.”